5 MINUTE READ

Written by Jabiha Razi

Psychological pricing is an important tactic that you can use to stimulate consumer spending and thereby increase your sales.

A fall in consumer spending is one of the main reasons for slowing economies. Governments try their best to provide a stimulus to growth in such conditions. Customers halt spending or postpone expenditures when they become uncertain about future income streams. They get into a state of inertia because of their over-focus on the risks associated with unpredictable and bleak future economic prospects. This unwillingness to purchase makes it difficult for businesses to make them spend at normal levels. Hence, the vicious cycle continues. How you frame the cost of your product or service directly affects your customer’s buying decision process. Businesses can help recover economies by resetting their customers’ focus through psychological pricing.

Generally, you use combinations of various strategies to arrive at a price. For instance, you look at your cost and expected returns, competitors’ prices, and the maximum price a market would give for your offering. Your pricing strategy also depends on the uniqueness of your product and the market size. You may also have different pricing for different geographic regions.

Based on the above factors, you choose a penetration, economic, premium or skimming pricing policy. For easily available items like groceries, you may prefer reduced margins and penetrate the mass market or decide to give no-frills services through economic pricing. For niche items like luxury watches, you may keep the prices premium and margins high. You may have a substantial competitive advantage in some sectors, allowing you to enjoy returns from skimming.

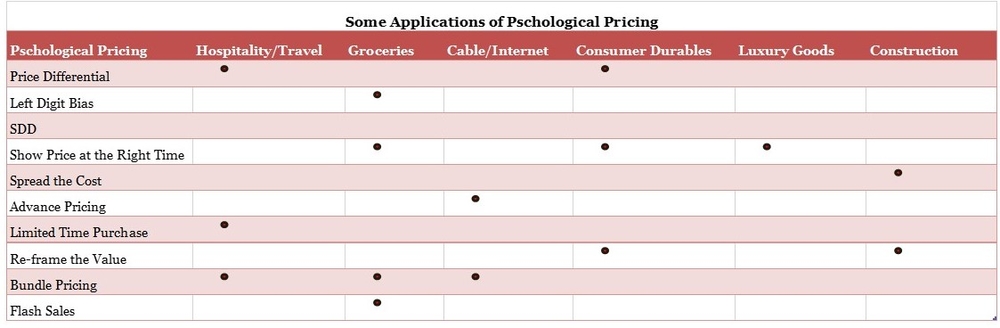

Whatever the strategy, using some combination of psychological pricing helps push customers into a buying mode. Here are a few examples of psychological pricing you can use to boost your sales.

Differential Price Framing – According to a study by the American Marketing Association in 2019, people consistently choose a premium higher-priced product, where a price difference rather than full price is emphasized; for instance, “for $20 more” instead of an absolute amount of, say, “$115”. This preference for the premium-priced product is due to the “pricing focalism”: The customer focuses on the price difference, not the total price, perceiving the product as less expensive. This preference is because the human brain does not want to make complex choices and defaults to easy solutions. This strategy works better if you have to show a bad deal option and where it is easy to compute price differences. Use this psychological pricing strategy for most of your upgrade and cross-sell options.

Left Digit Bias – For long, businesses have used charm pricing to enable quick purchase decisions; for instance, instead of keeping a price tag of a round number, the price ending in .95 or .99. According to a study published in the Journal of Consumer Research in 2005, this pricing tactic becomes more effective when you consider the digit on the left side. Hence, the price comparison of 4.99 vs 5 is more appealing than 4.98 vs 4.99, although the price difference is the same. The reason for this is the left-digit bias of our brains. You can use this psychological pricing for low-cost grocery items.

Steadily Decreasing Discounts – Businesses generally give a fixed discount rate for a specific period and retract it entirely. But according to research published in the Journal of Marketing in 2010, steadily decreasing a discount gives consumers a signal that the prices in future will increase. They are more willing to buy as their anticipation of regret increases. You can use this psychological technique for high-valued products like consumer electronics.

Show Price at the Right Time – There is a debate about the right time to reveal a price. Should it be revealed before showing a product or afterwards? According to a study published in the Journal of Marketing Research, you should show the price before the product for cost-conscious decision-makers and low-cost products. And show the price after a product for premium products. Price primacy gives a perception of bargain products. Displaying the price after a product frames a customer’s mind towards its benefits or high quality. You can use both psychological pricing tactics depending on the type of product variety at your store. For instance, you may want to sell an everyday T-Shirt based on price primacy; therefore, you may display a prominent price sticker on the shelf. Again, you may want to sell a branded jacket based on its perceived quality; consequently, you may discreetly keep the tag inside the pocket.

Spread the Cost Over the Lifetime – If the price of your offering is perceived to be high, make your customer visualize its value effectively by dividing its cost on a daily or usage basis. For instance, the price of a computer may look high, but spreading its cost on the number of hours worked or on a per-day basis would enhance its experiential value, thereby justifying the total price.

Advance Pricing – Customers sometimes feel the pain of recurring expenses, even if the item is of value to them. They tend to slash such costs. This trend is especially valid for customers having tight monthly budgets. The best way to remove recurring payment pain is to charge for the service or item in advance, as in a subscription, rather than monthly. You can state the value of advance pricing by showing the customer the uninterrupted use of the service for a year. Customers often forget the pain of spending once they have incurred the expense.

Limited Time Purchases – Sometimes, you must buy a product within a time frame, and its price is also liable to change. However, you are unaware if its price will go up or down soon. Customers find it difficult to ascertain the “right time to purchase”. According to a study by the University of Zurich, customers continue to lower their standards as the time to purchase keeps nearing and end up buying higher-priced options. This psychological pricing technique can be used to book hotel rooms or other limited-time offers.

Re-frame the Value – Price acceptability, and consequently, buying, is a function of how well you have framed the value of your product. Align the price to a rich, lasting experience or removal of a customer’s pain as a result of the purchase. A well-aligned price-value relationship works best with many high-priced items and also with several professional services. For instance, financial consultants can show the loss arising from a wrongly planned financial decision to show the value of their services.

Bundle Pricing – When COVID-19 became a pandemic, consumers rushed to purchase essential grocery items. Many retailers helped reduce the stay time in stores and buying decision time by offering special bundle packs of essential items needed by the households. With such bundles or baskets of products, you can give an overall lower price than selling the items separately, creating a win-win situation for both the customer and yourself through psychological pricing.

Flash Sales – As discussed in a previous article, retailers now have the option to push notifications to buyers through their branded smartphone applications. Recently, flash sales have become a common feature in such apps. This psychological pricing technique has helped increase impulse buying among customers. You can also create customized flash sales through machine learning to increase the chances of buying.

Hence, there are many pricing options that you may use to initiate consumer buying. Look at your product or service inventory and see which psychological pricing best fits your business needs and creates the most value for your customers.